Managed futures are a highly flexible alternative investment traded on many financial and commodity markets around the world. By broadly diversifying across markets, managed futures may simultaneously profit from price changes in stock indices, treasury futures or bond futures, and currencies, as well as from diverse commodity markets having virtually no correlation to traditional asset classes such as the stock market.

Modern Portfolio Theory first developed by Harry Markowitz of the University of Chicago in 1952 dictates that a diversified portfolio of uncorrelated assets can provide maximum return for minimal volatility. Managed futures offer investors one of the most uncorrelated and independent investments relative to most other traditional asset classes.

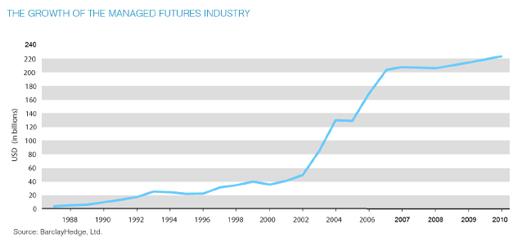

Why has there been such substantial growth in managed futures?

Recent growth in managed futures has been substantial. In 2002, it was estimated that more than $45 billion was under management by managed futures trading advisors. By the end of 2007, that number had grown to more than $200 billion. Managed futures have historically been uncorrelated with the returns in traditional asset classes, enabling them to enhance returns as well as lower overall volatility.

The benefits of managed futures within a well-balanced portfolio include:

· Potential to lower overall portfolio risk;

· Opportunity to enhance overall portfolio returns;

· Broad diversification opportunities;

· Opportunity to profit in a variety of economic environments; and

· Limited losses due to a combination of flexibility and discipline.

Managed futures are investment products in which professional money managers called Commodity Trading Advisors ("CTAs") direct investments in the futures markets utilizing futures contracts and/or options on futures. While investment management professionals have been using managed futures for more than 30 years, institutional investors such as corporate and public pension funds, endowments and banks have more recently begun to employ managed futures in pursuit of a well-diversified portfolio.

Academic research on the suitability of managed futures has been significant and supportive of the investments. For example, in a 1983 landmark study entitled "The Potential Role of Managed Futures Accounts in Portfolios of Stocks and Bonds," Dr. John Lintner of Harvard University found that "portfolios . . . including judicious investments . . . in leveraged managed futures accounts show substantially less risk at every possible level of expected return than portfolios of stocks (or stocks and bonds) alone."

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future results. There are no guarantees of profit no matter who is managing your money. An investor must read and understand the Commodity Trading Advisor's current disclosure document before investing.

To learn more about managed futures, please read "Managed Futures: Portfolio Diversification Opportunities" from CME Group.